As a business owner, you must understand the difference between gross profit margin and markup. They conceptually sound the same, but they have very different implications for your business.

Gross profit margin is the percentage of revenue your company keeps after accounting for the cost of goods sold. On the other hand, markup is the percentage increase you add to the cost of goods sold to arrive at the selling price.

The gross profit margin is a measure of profitability, while markup is a measure of pricing. The key difference between gross profit margin and markup is that gross profit margin looks at the percentage of revenue your company keeps after accounting for the cost of goods sold. In contrast, markup looks at the percentage increase you add to the cost of goods sold to arrive at the selling price.

While they are both crucial measures, the gross profit margin is typically given more weight when assessing a company’s financial health because it provides insights into how much money a company makes after accounting for its direct costs. On the other hand, markup is used more as a tool for setting prices.

Now that you understand the difference between gross profit margin and markup, you can use this knowledge to make informed decisions about pricing and profitability for your business.

How to Calculate Markup for your business.

Markup is essential because it allows you to cover your costs and make a profit. Markup is the difference between the wholesale cost of an item or service and its selling price. To calculate markup, divide the selling price by the wholesale cost, then multiply by 100 to get a percentage. For example, if an item costs $10 to produce and you sell it for $15, your markup would be 50%.

Once you’ve determined your ideal markup, you can use it to calculate your desired profit margin. However, it’s necessary to balance markup and sales volume. If your markup is too high, you may price yourself out of the market. Too low, and you may not be able to cover your costs. The sweet spot will vary from industry to industry, so it’s essential to do your research before setting your prices.

How to Calculate Gross Profit Margin.

Profit margin is the percentage of the selling price that is profit. To calculate gross profit margin, divide gross profit by the selling price. The result is expressed as a percentage. For example, if a company has a gross profit of $10,000 on sales of $100,000, its gross profit margin would be 10 percent.

At this point, you should realize that gross profit and markup are addressing the same thing, the difference between the cost of goods sold and the selling price, but it is approached from a different angle.

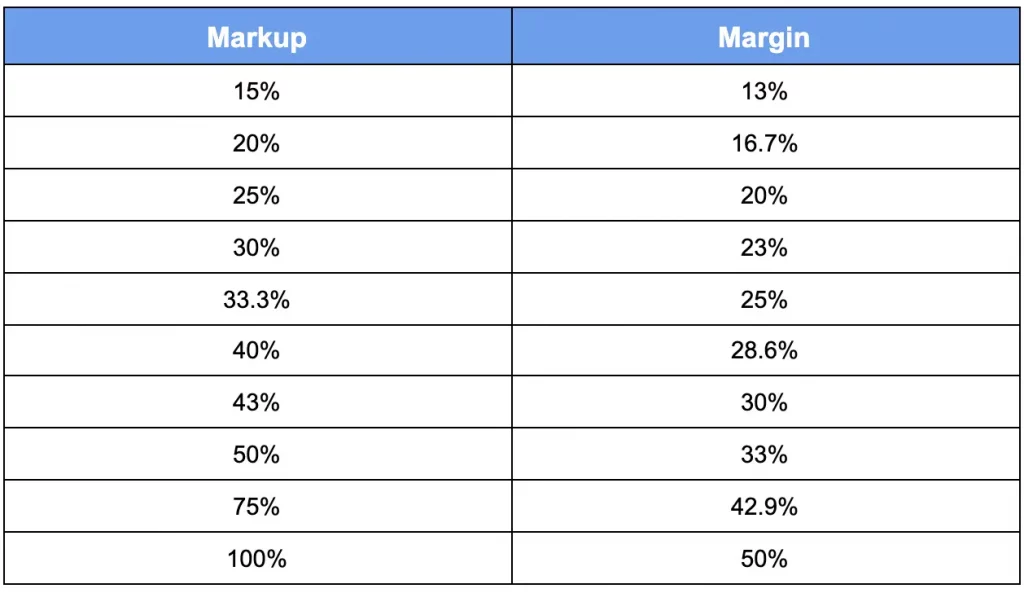

Here is how I remember it: markup is calculated using your cost and profit margin using the selling price. And yes, you need to know both. Let’s look at a visual comparison to understand it more clearly.

Here is an example: Your product costs $25.00, and you sell the product for $50.00, so your profit is $25.00.

Markup: Cost is $25.00 and profit is $25.00 thus markup is (25/25)*100 = 100% or (Gross Profit/Cost Price) *100

Profit Margin: Selling Price is $50.00, and profit is $25.00; thus, profit margin is (25/50)*100 = 50% or (Gross Profit/Selling Price)*100

Conclusion

One of the first questions I ask new clients is to tell me their gross profit margin, and 9 out of ten times, the explanation given is really for markup. It is not a good situation to be in, and the reason is straightforward if you are under the impression that your gross profit margin is 25%, but you are using the 25% to calculate your markup, your gross profit margin is only 20%.

At this point, most business owners typically think that the above article is too technical, and you are right. It is a bit technical. Remember, markup is calculated on costs and profit margin on selling price. The second thing I need you to remember is that these metrics are essential to your business.

In the following article, I will discuss how to use markup and profit margin to make some strategic decisions.

Please feel free to contact me if you need any help implementing this in your business.

Pro Tip: If you are using Quick Books, there is a quick way to look up your profit margin. Here’s how:

Reports – Profit and Loss Statement – Move the mouse over the compare to another period and click the drop-down arrow – click on the option that states % of income and then click on run report.

This will only work if you have categorized your expenses into direct, operation, and other costs. If your profit and loss are not set up like this, don’t hesitate to contact me; I will be happy to help in this manner.